Rowan County Property Appraiser

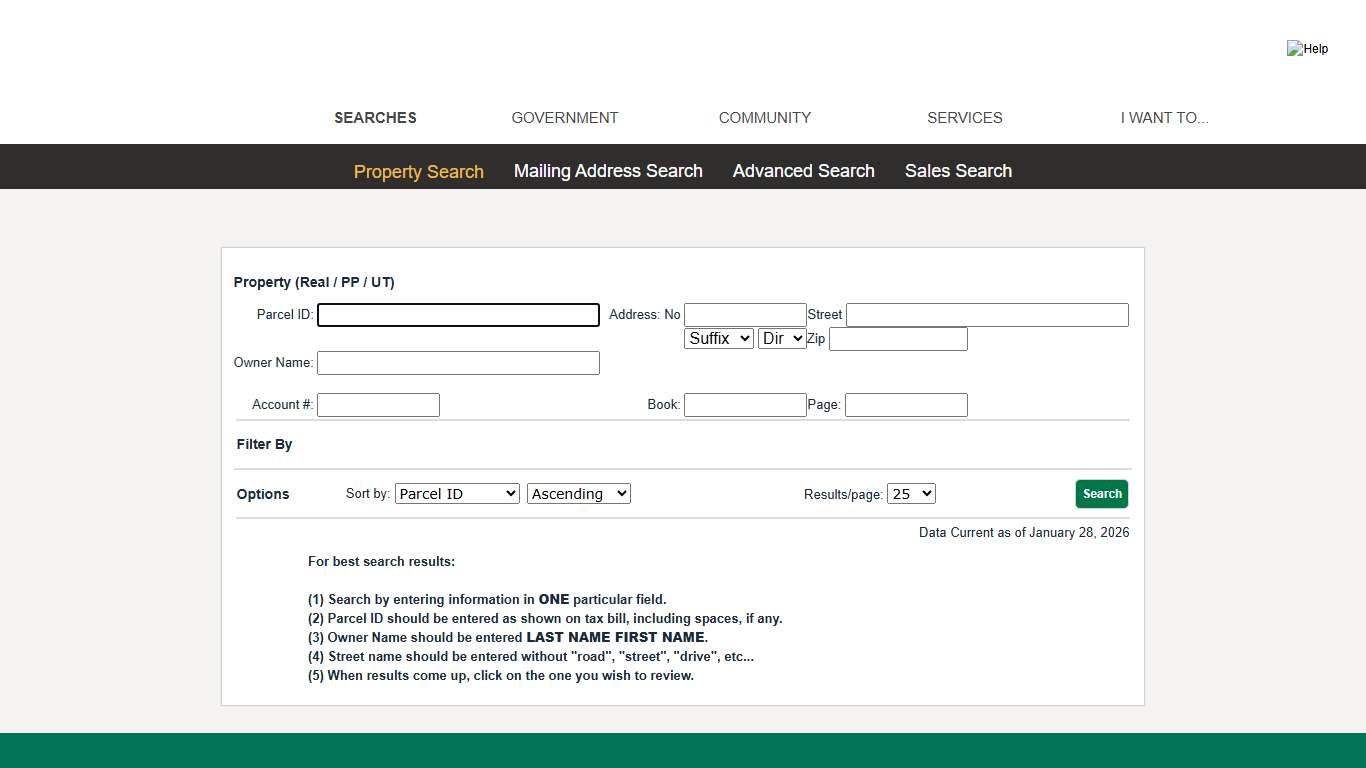

Rowan County - Property (Real / PP / UT) Search

Property Search · Mailing Address Search · Advanced Search · Sales Search. Property (Real ... 2025 by Rowan County, NC Last Updated: January 24, 2026.

https://tax.rowancountync.gov/

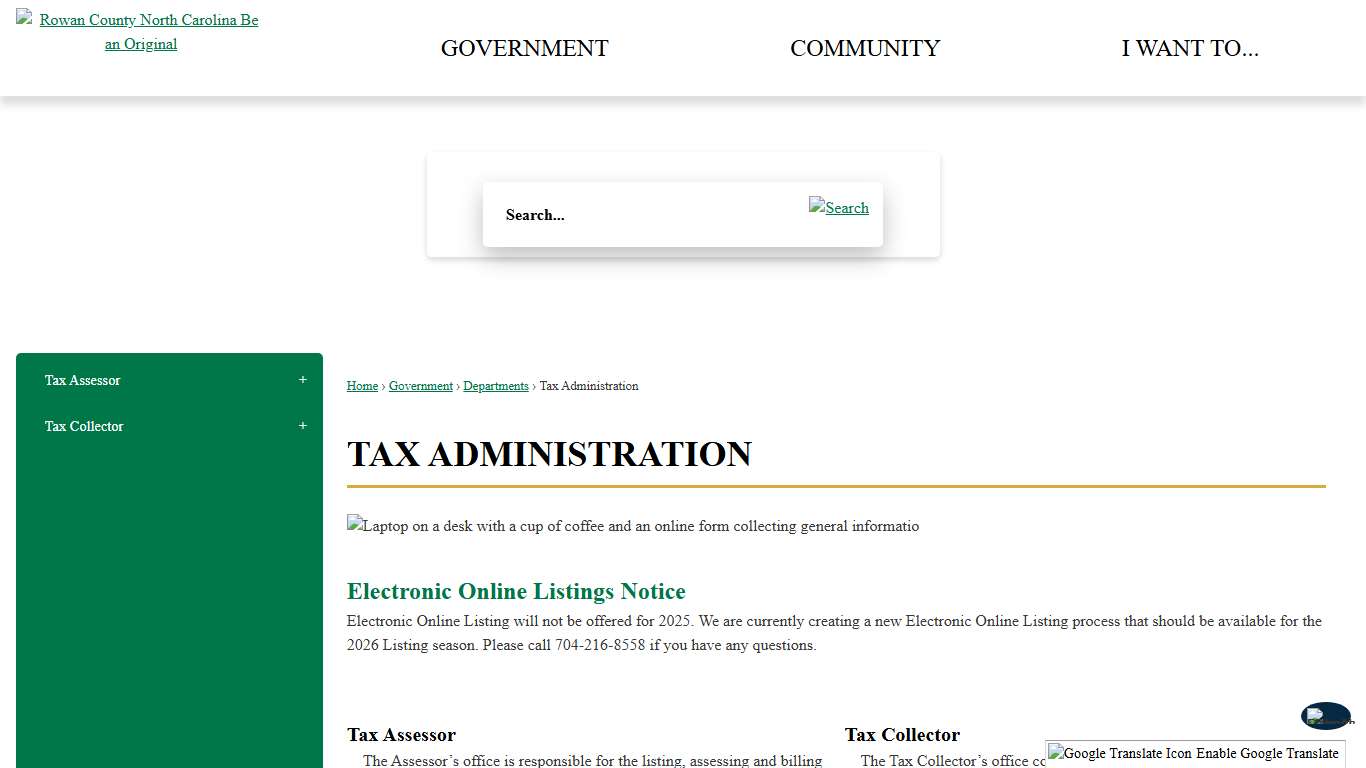

Tax Administration Rowan County

Electronic Online Listing will not be offered for 2025. We are currently creating a new Electronic Online Listing process that should be available for the 2026 Listing season. Please call 704-216-8558 if you have any questions.

https://www.rowancountync.gov/1139/Tax-Administration

Next County 2025-26 2024-25 2023-24 2022-23 2021-22 ...

2026. Ashe .4400 .4400 .4400 .5100 .5100. 2023. 2027. Avery .4000 .4000 .4000 ... NORTH CAROLINA COUNTY PROPERTY TAX RATES. FOR THE LAST FIVE YEARS. (All ...

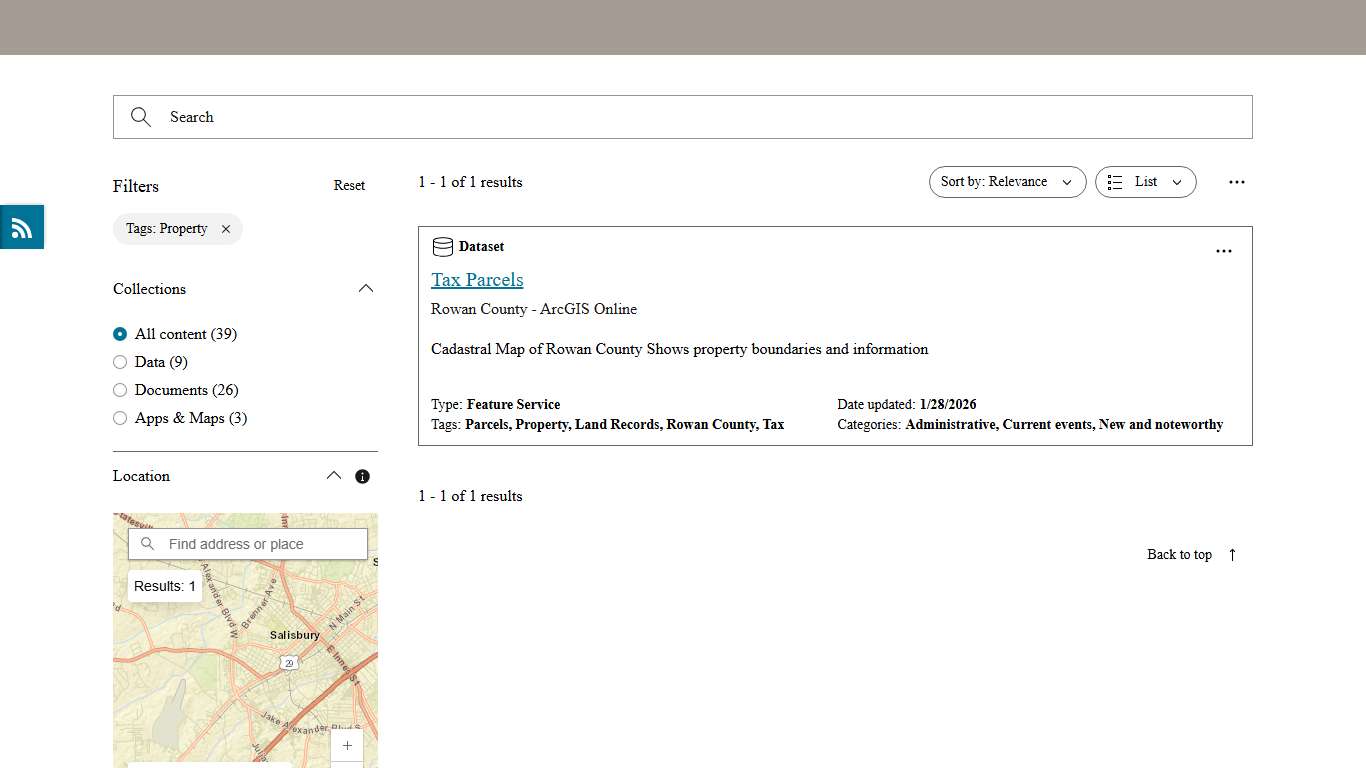

https://www.ncdor.gov/2025-2026-county-tax-rates-finalpdf/openRowan County Open Data Portal

Stay up to date on changes to the search catalog through the available feeds. Add RSS (guide) to an aggregator such as Inoreader or Feedly and see daily changes to this site's content. Use the DCAT feeds to federate this site's content with external catalogs like data.gov or data.europa.eu.

https://gisdata-rowancountync.opendata.arcgis.com/search?tags=Property

Rowan County, NC Property Tax Calculator 2025-2026

Calculate Your Rowan County Property Taxes Rowan County Tax Information How are Property Taxes Calculated in Rowan County? Property taxes in Rowan County, North Carolina are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.71% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/northcarolina/rowan-county

rowan county

This phase will be complete by July 31, 2025. Sales study will continue through December 31, 2026. PHASE 2: Commercial/Industrial field work, on ...

https://evp.nc.gov/_entity/annotation/032805b7-41ac-ef11-b8e9-001dd830a601/863ea987-6d3e-ed11-9daf-001dd805ec0b?t=1732665600265Rowan County Candidate Filings for 2026 ...

2026 Personal Property Tax Forms and Instructions are available in excel format. Please request the forms with an email message to [email protected]. or ...

https://kynewsgroup.com/rcn010826retry.pdfExemptions Rowan County

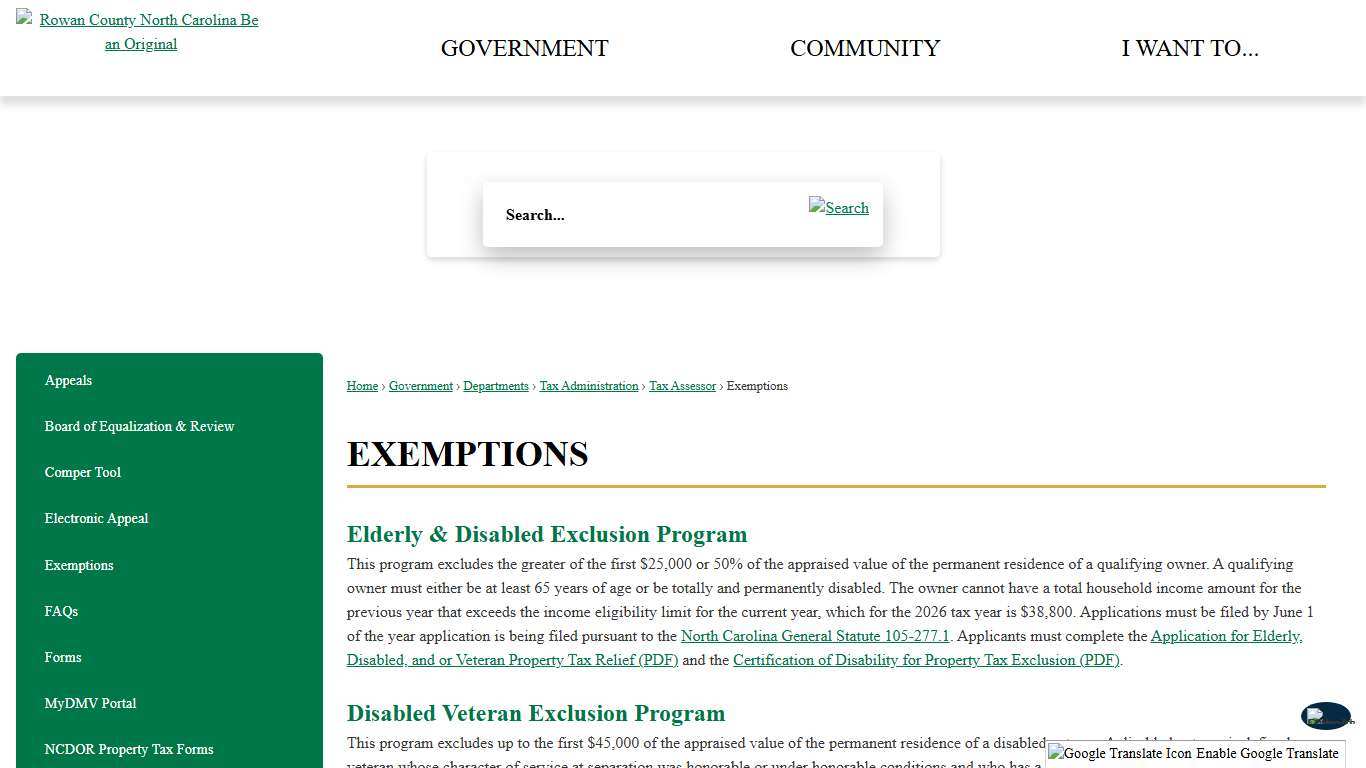

Exemptions Elderly & Disabled Exclusion Program This program excludes the greater of the first $25,000 or 50% of the appraised value of the permanent residence of a qualifying owner. A qualifying owner must either be at least 65 years of age or be totally and permanently disabled.

https://www.rowancountync.gov/482/Exemptions

Property Taxes - Rowan Country Sheriff's Department

The Rowan County, KY Sheriff’s Department is now accepting Visa, MasterCard, American Express, Discover credit cards for tax payments. A convenience fee of 2.49% for payments over $60.00 or a flat fee of $1.50 for payments under $60.00, charged by a third party vendor, will be added to all credit transactions.

https://rowancountysheriff.net/property-taxes/

Rowan 2025/2026 budget first reading passes unopposed through Fiscal Court

The Rowan County Fiscal Court heard the first reading of the upcoming fiscal year budget, covering county expenses from July 2025 through June 2026. The first draft included some increases to account for general inflation, though there aren’t any tax increases for county residents.

https://www.wmky.org/news/2025-04-04/rowan-2025-2026-budget-first-reading-passes-unopposed-through-fiscal-court

AV-9 2026 Application for Property Tax Relief NCDOR

Some NCDOR offices may be closed to the public today. Please call ahead if you need to visit an office. Help is also available by calling 1-877-252-3052. A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply.

https://www.ncdor.gov/av-9-2026-application-property-tax-relief

Regular Scheduled January 2026 Meeting Rowan County Fiscal Court Facebook

Regular Scheduled January 2026 Meeting...

https://www.facebook.com/RCFiscalCourt/videos/rowan-county-fiscal-court/856115983866296/

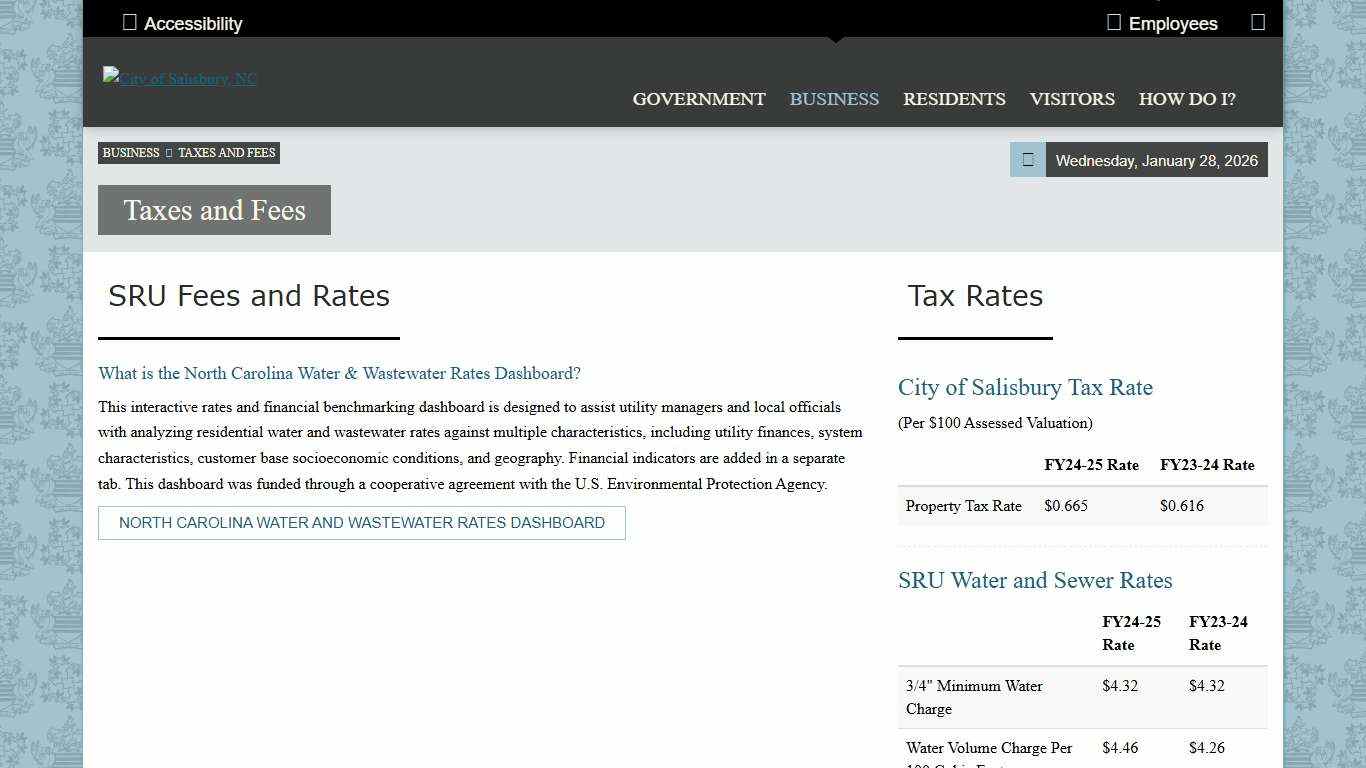

Taxes and Fees

What is the North Carolina Water & Wastewater Rates Dashboard? This interactive rates and financial benchmarking dashboard is designed to assist utility managers and local officials with analyzing residential water and wastewater rates against multiple characteristics, including utility finances, system characteristics, customer base socioeconomic conditions, and geography.

https://salisburync.gov/Business/Taxes-and-Fees

Real Estate Appraisal in Salisbury, North Carolina 7046402228

As licensed appraisers, we possess the training and credentials to generate the type of reliable property value opinions that banks and national lending institutions require for mortgages. With years of experience under our belt, we're more than ready to handle practically any type of property.

https://grahamresidentialappraisalsinc2.appraiserxsites.com/

2026 Tax Assessment List Proof Book

2026 Tax Assessment List Proof Book Public Notice – 2026 Tax Assessment List Notice is hereby given that the 2026 Tax Assessment List Proof Book will be available for public inspection on Wednesday, October 22, 2025. 9:00 a.m. – 3:00 p.m. 9:00 a.m. – 3:00 p.m. Tabernacle Township 163 Carranza Road Tabernacle, NJ 08088 James J. Renwick Certified Tax Assessor...

https://www.tabernacle-nj.gov/news_detail_T2_R1055.php

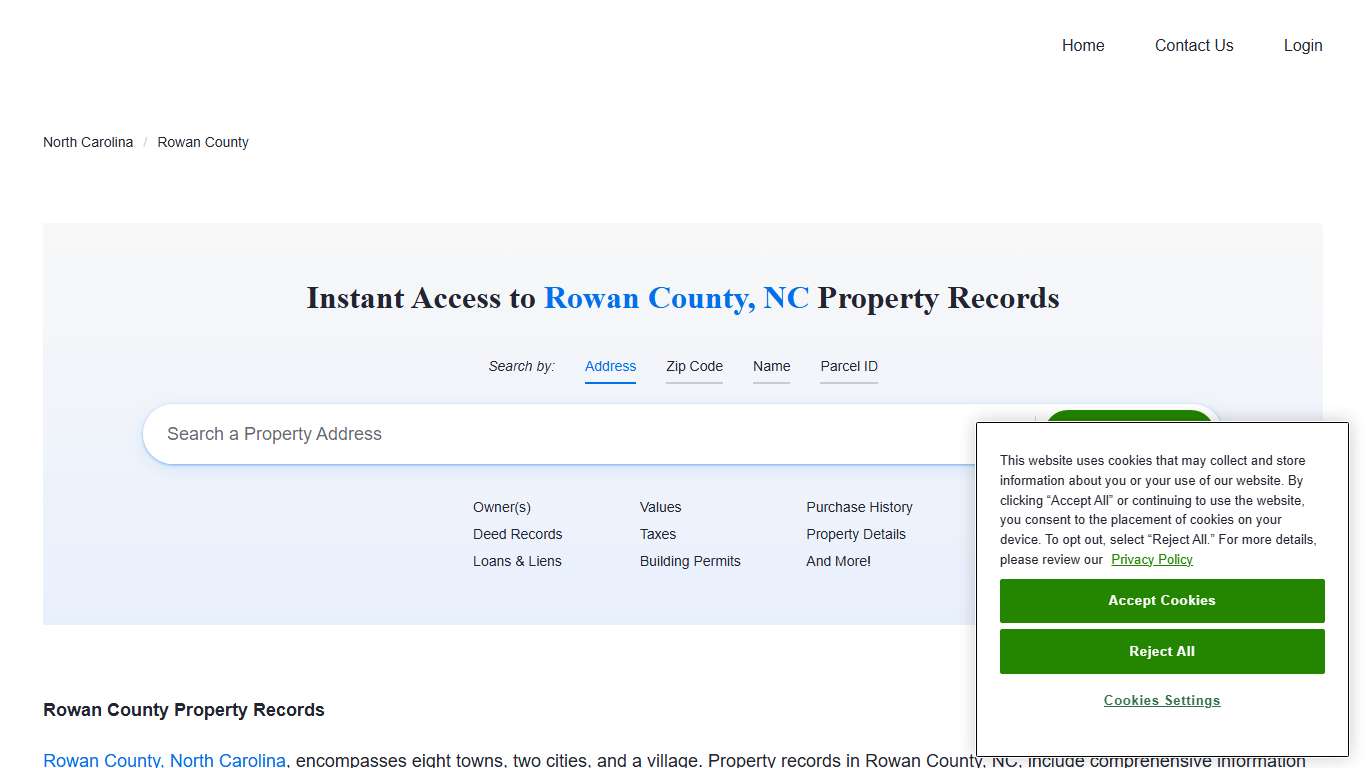

Rowan County, NC Property Records Owners, Deeds, Permits

Instant Access to Rowan County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Rowan County, North Carolina, encompasses eight towns, two cities, and a village.

https://northcarolina.propertychecker.com/rowan-county

Exemptions Rowan County

Exemptions Elderly & Disabled Exclusion Program This program excludes the greater of the first $25,000 or 50% of the appraised value of the permanent residence of a qualifying owner. A qualifying owner must either be at least 65 years of age or be totally and permanently disabled.

https://www.rowancountync.gov/482/Exemptions

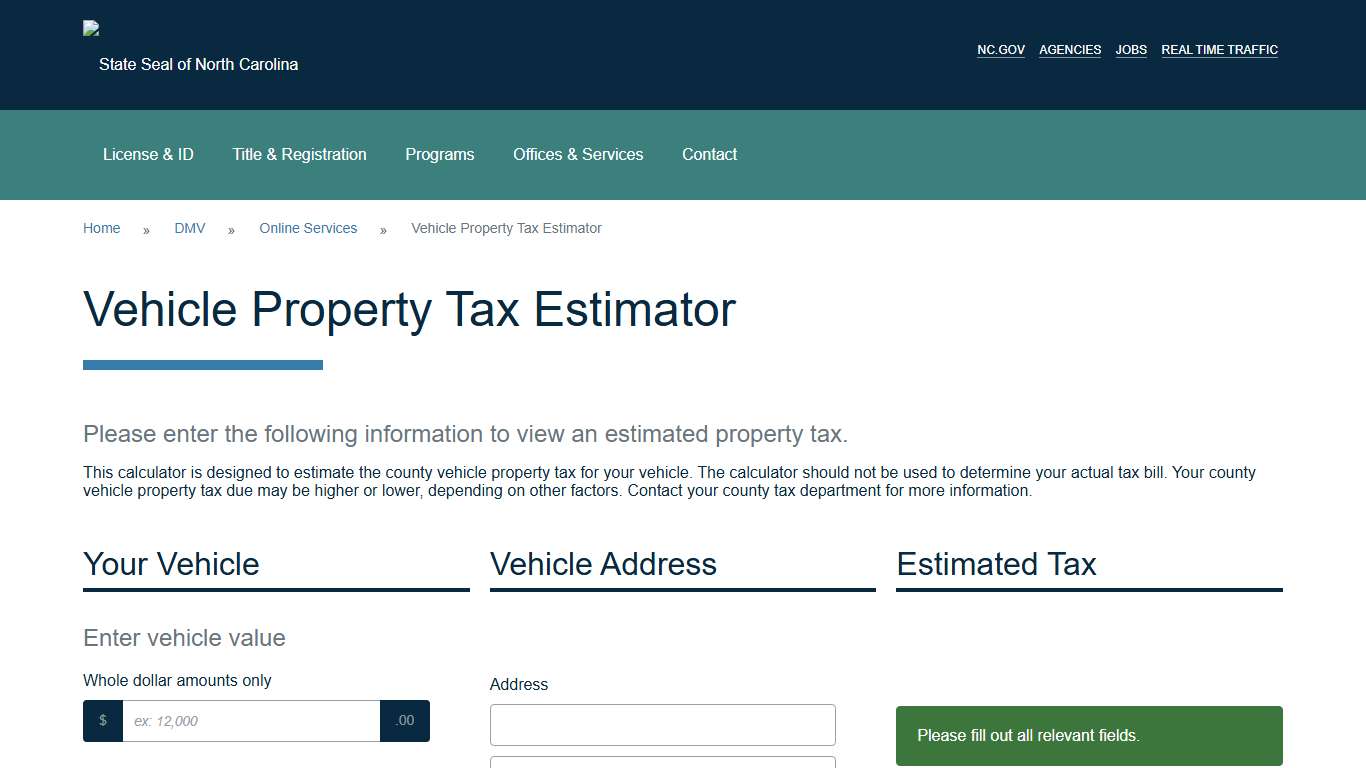

North Carolina Vehicle Property Tax Estimator

Please enter the following information to view an estimated property tax. This calculator is designed to estimate the county vehicle property tax for your vehicle. The calculator should not be used to determine your actual tax bill. Your county vehicle property tax due may be higher or lower, depending on other factors. Contact your county tax department for more information.

https://edmv.ncdot.gov/TaxEstimator